An Infrequent Look at Analytical Tools: VRIO Analysis

I’m going to start an ongoing, if infrequent, topic. I enjoy the analytical process and I especially like helping those companies I work with gain competitive advantage, whether through a sound understanding of the competitive environment or by looking internally. Over the next couple of months, I’ll be posting some of my thoughts on some of the tools that are often underutilized or used wrong (I’m looking at you SWOT).

So, without further ado, VRIO analysis:

VRIO stands for Value, Rare, Imitable, and Organized. VRIO analysis is a strategic tool used to evaluate a company's resources and capabilities. The tool provides a framework for determining whether or not these assets can lead to a sustainable competitive advantage. By examining each of the VRIO elements, companies can develop strategies to capitalize on that which will give them a competitive edge.

Value

A resource or capability is considered valuable if it helps a company neutralize threats or exploit opportunities in its environment. This can be achieved in several ways:

Increasing revenue: Valuable “property” can help a company generate more revenue through increased sales, higher prices, or new product offerings. For example, a company with a strong brand reputation can charge a premium for its products.

Cost reduction: Valuable resources can help a company reduce costs by improving efficiency, streamlining operations, or negotiating better deals with suppliers. For instance, a company with a proprietary manufacturing process may be able to produce goods at a lower cost than its competitors and still retain a price premium, increasing margin.

Improved customer satisfaction: Often measured by Net Promoter Score (NPS), increased customer satisfaction may be achieved by providing a better quality of product or service, enhanced customer service, or strengthening relationships with customers. A company with a highly skilled workforce, for example, may be able to offer superior customer support.

Rare

A resource or capability is rare if it is not widely (or at all) available to competitors. If many other companies possess the same resource, that resource or property cannot provide a competitive advantage. For example, a company with a large customer base may have a competitive advantage if its competitors have smaller customer bases. However, if many other companies also have large customer bases, this advantage may be less significant.

Imitability (or Inimitability)

Though sometimes a challenge to pronounce, a resource or capability is inimitable if it is difficult or costly for competitors to imitate. If competitors can easily replicate a resource or capability, it cannot provide a sustainable competitive advantage. Several factors that can make a resource or capability inimitable:

Historical context: Some resources or capabilities may be the result of a company's unique history or experiences. For example, a company that has been operating in a particular industry for many years may have developed deep relationships with suppliers or customers that are difficult or costly for competitors to replicate.

Causal ambiguity: Believe it or not, causal ambiguity is the subject of a significant body of research in business and strategy. The idea is that it may be difficult for competitors to understand the exact nature of a resource or capability and how that “thing” (or series of “things”) contributes to the company's or product’s success. This can make it difficult for them to imitate the resource or capability effectively. Alexander the Great’s Royal Companions (those who grew up with and trained with him in his youth) may be one such example. Though they appeared to be just another set of cavalry, they were fiercely loyal to the king and ferocious in battle. The “cause” of their behavior in battle might be ambiguous to the Persians but is based on friendships developing since boyhood.

Social complexity: Some resources or capabilities may be based on social relationships or cultural factors that are difficult to replicate. For example, a company's strong corporate culture may be difficult for competitors to imitate.

Organized

A resource or capability is organized if the company has the necessary structure, processes, and culture to exploit it effectively. If a company lacks the proper organization, it cannot fully leverage its resources and capabilities. For example, a company with a highly skilled workforce may not be able to realize its full potential if it does not have the appropriate management systems or incentives in place.

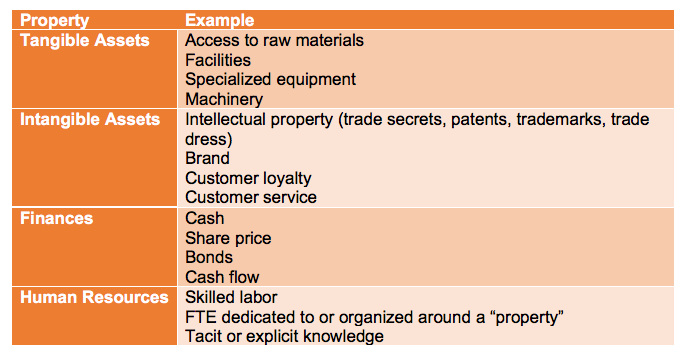

Valuable “Properties” (not exhaustive)

Thought Process

Examples of VRIO Analysis

Let's consider two examples:

Apple

Value: Apple's innovative product design, strong brand reputation, and efficient supply chain management are all valuable resources and each contributes to the company’s success.

Rare: Apple's ability to consistently introduce new products (or features) and maintain a high level of customer loyalty is rare.

Imitable: While competitors can try to imitate Apple's products and marketing strategies, it is difficult for them to replicate the company's culture and innovation capabilities.

Organized: Apple is highly organized around its products and, to a great extent, it’s brand. This effective and efficient organizational structure allows it to focus on development, production, and marketing its products.

Amazon

Value: Amazon's vast product selection, efficient logistics network, and customer-centric approach are all valuable resources that contribute to its success.

Rare: The company’s scale and scope of operations, as well as its ability to leverage technology to improve its business processes, are rare.

Imitable: While competitors can try to imitate Amazon's business model and technology, it is difficult for them to replicate the company's scale, customer base, and brand recognition.

Organized: Highly organized and adaptable, the company’s organizational structure that allows it to quickly respond to changes expand into new areas.

The VRIO framework is a powerful tool for identifying and assessing a company's competitive advantages. By examining the value, rarity, imitability, and organization of a company's resources and capabilities, managers can develop strategies to sustain and strengthen their a strong competitive position.

Pros and Cons

Even though VRIO can be a great tool for analysis of internal capabilities to try to capture competitive advantage, it is not always the right tool (I’m looking at you again, SWOT).

Pros

Easy to Use: The framework is a linear way of looking at those properties which may provide competitive advantage and evaluating those.

Advantage Identification: The tool and the process of going through the exercise (read, “Doing the work necessary to make it effective) will help a company identify areas of competitive advantage to exploit in the marketplace.

Informs Innovation: The framework’s results can help a company build out and / or develop on existing competitive advantage. Used with other analytical tools, VRIO can be an arrow in a company’s quiver for growth.

Cons

Navel-Gazing: The framework looks only at internal strengths, but these have to meet market opportunities. While it can be a great tool to help identify strengths, it cannot be a stand-alone analytical tool, especially when looking to develop a growth strategy.

Pronounceability: Neither “imitability” nor “inimitability” roll off the tongue. VRIO itself is a pretty terrible name.

Necessary Planning: In today’s world of the desire for easy and immediate gratification, the work needed to conduct a good VRIO analysis (or almost any other analysis, for that matter) requires planning. My drill instructor, Staff Sgt. Barber, USMC, used to say (yell), “Proper planning prevents poor performance.” I think he was paraphrasing Aristotle who said, “Well begun is half done,” which I suspect did not rhyme in ancient Greek. Regardless, be prepared to prepare or the entire process will become an unorganized, unfocused, and biased wreck - and your reputation won’t be far behind.